Success-stories

A RideWallet Elevates Financial Risk Management with NebulaGraph

This RideWallet is a leading force in the urban mobility payment industry worldwide. Integrated on the world’s renowned mobility service platform, the RideWallet has seamlessly facilitated millions of transactions, ensuring that passengers can effortlessly pay for their rides and other mobility services throughout the ride. In addition to the ride payment, it supports a wide range of payment methods, including credit/debit cards, mobile wallets, loans and various local payment options tailored to regional needs. In a short sentence, the RideWallet originated from the mobility service and evolved into a comprehensive payment solution.

Rapid Expansion in Latin America Brings Financial Risk Management Challenges

In recent years, the RideWallet has been expanding rapidly, particularly in the Latin American market; for example, in Mexico alone, the company has issued over 5 million loans. However, with the boost of the business, it faces significant challenges in financial risk management. The increasing geographical footprint has led to a surge in data volume, necessitating a system that can deliver faster response times, heightened accuracy, and unwavering stability. The company encountered several critical challenges in its financial risk management operations:

Real-time Risk Control for Loan and New Card Issuance: The consumer loan business, aimed at individual applicants, experiences high concurrency due to a large user base. To ensure a good user experience during the application process, the risk control decision engine cannot tolerate query delays exceeding one second. This places high demands on the graph technology's performance.

Mid-loan and Card Usage Risk Control: Given the company's focus on the Latin American market, particularly Mexico, the relatively lenient overseas loan and credit card usage policies pose significant risks. Some payment institutions do not even verify CVV codes, leading to frequent misuse of loan and credit card limits. Traditional risk control rules struggle to accurately assess risks during the usage process.

Fraud Ring Detection: For personal credit businesses, the risk control department is particularly concerned about fraud rings. Compared to individual loan application fraud, organized fraud poses a much greater threat. Therefore, accurately identifying high-risk communities is crucial to minimizing financial losses.

NebulaGraph: Delivering Real-Time, High-Performance Risk Management Solutions

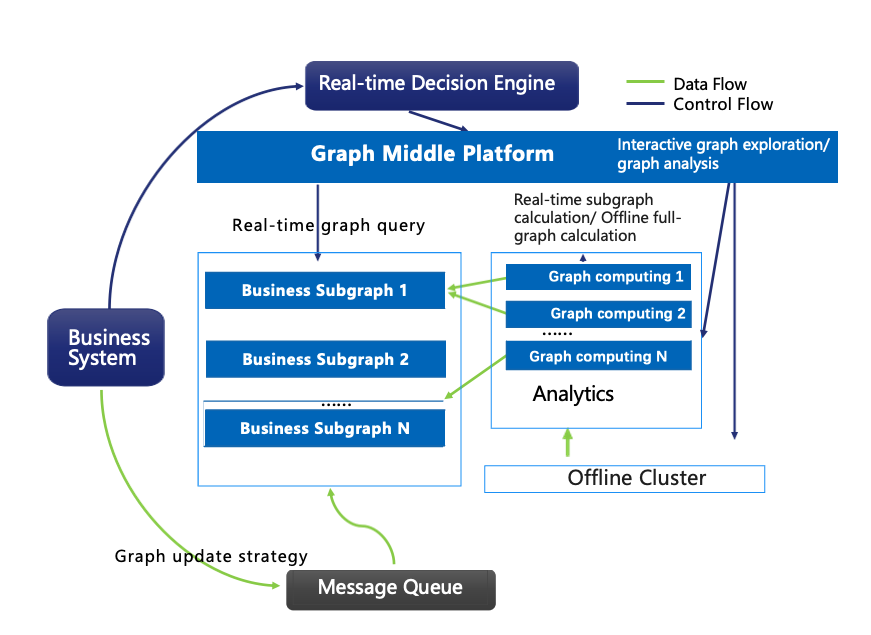

To address these complex challenges, NebulaGraph provided a comprehensive and efficient solution. NebulaGraph supports real-time graph construction, enabling full-graph risk control based on real-time application data. With its high-performance data processing engine, the system can handle ultra-high concurrency, real-time bulk writes, and queries, ensuring stable operation even during peak times.

In terms of performance, NebulaGraph boasts exceptional computational capabilities, completing queries and calculations within the decision engine's tolerable time frame, ensuring the effectiveness of real-time rules. The system employs advanced graph computation algorithms, combining real-time and asynchronous methods to extract relevant subgraphs from application data for asynchronous computation and then reintegrate them. This approach not only enhances processing efficiency but also ensures data accuracy and real-time performance.

Furthermore, NebulaGraph offers elastic scaling capabilities, allowing online scaling to ensure uninterrupted business operations. The system can smoothly expand from 3 nodes to 12 nodes, and further scale online as needed to accommodate business growth, ensuring flexibility in response to increasing business demands.

The RideWallet's Use of NebulaGraph for Risk Control

The RideWallet leverages NebulaGraph in several key areas:

Real-time Risk Control During Loan Application: Using the graph database, the system performs real-time queries to check if the applicant's IP address is a known blacklisted IP or if it connects to numerous devices. It also checks within three hops if the contact information provided by the user links to any blacklisted users.

Real-time Risk Control During Loan Usage: Based on the fund flow graph, the system queries whether the user's loan funds are transferred to accounts that do not comply with the loan's intended use.

Risk Community Detection: Using offline graph computations (WCC, Louvain), the system identifies communities closely linked to blacklisted nodes with high concentrations of black points. It extracts community features, such as the presence of multiple accounts with unidirectional transactions, a high proportion of midnight transactions, and several nodes with high PageRank values. These features are then fed into machine learning models for risk control decision-making.

System Architecture of the RideWallet

System Architecture of the RideWallet

Achieving Significant Improvements with NebulaGraph's Advanced Capabilities

By adopting NebulaGraph's solution, RideWallet's credit and payment departments achieved significant improvements in multiple areas:

Business Value: The enhanced risk control capabilities met the business expansion requirements, handling 3.3 billion edges and 630 million nodes. Through complex computations, the multi-stage risk control capabilities for application, credit approval, and loan usage based on graph technology were significantly improved, addressing data quality issues and enhancing overall risk control quality.

Technical Excellence: NebulaGraph provided a stable, low-latency, high-throughput graph cluster capable of real-time updates, queries, and handling asynchronous computation tasks with a 4:9:1 ratio. Its distributed architecture and advanced graph computation technology ensured excellent performance in high-concurrency and complex computational environments, maintaining business continuity and stability.

Elastic Scalability: NebulaGraph's elastic scaling capability allowed the system to smoothly expand from 3 nodes to 12 nodes, and further scale online as needed to accommodate business growth. This flexibility ensured the system could respond to business growth at any time, avoiding performance bottlenecks and service interruptions due to delayed scaling.

In summary, NebulaGraph's outstanding performance and powerful graph computation capabilities helped the customer achieve efficient real-time full-graph risk control, significantly enhancing both business and technical value.